Arkansas Retirement Planning

TSA Financial

Retirement is personal. You’ve worked hard to save and invest your money and now it’s time to optimize and protect your savings to provide for your retirement and your loved ones thereafter.

TSA Financial is an independent financial services firm, specializing in helping individuals and families prepare for, plan, and live in retirement. Our approach focuses on tailored retirement planning strategies and insurance solutions to provide our clients with guaranteed lifetime income, asset protection, and achieve tax efficiencies in support of a holistic approach to their finances.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

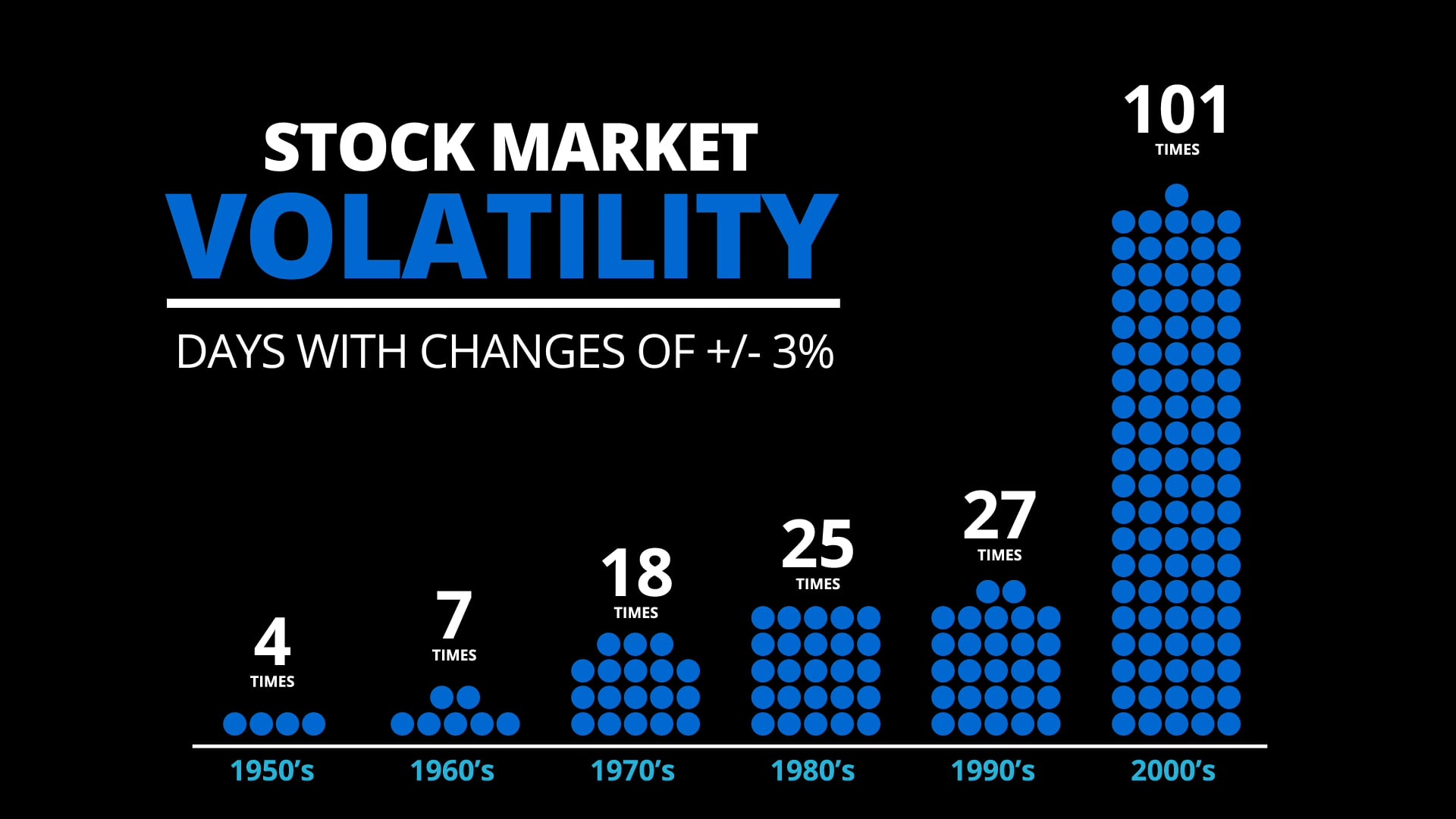

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Casey Burks

Founder/CEO

Casey Burks is the Founder and CEO of TSA Financial, leveraging over 19 years of dedicated experience in financial services. A proud graduate of Hardin County High School.

His professional journey began at The Hartford Group, where from 2007 to 2012, he successfully served as a Life Producer. Casey then transitioned into financial advising, providing expert guidance at Pro Benefits Group from 2012 until 2020. Recognized consistently for excellence, he was honored as American National’s “Agent of the Year” in 2016 and again in 2018, distinguished among 6,000 agents. Additionally, Casey was awarded the esteemed “Spirit of a Leader Award” in 2017, further solidifying his reputation for leadership and commitment.

Passionate about safeguarding his clients’ financial futures, Casey specializes in secure money alternatives designed to protect retirement assets while fostering growth. His proven track record underscores his unwavering commitment to guiding individuals toward achieving their financial goals.

Outside of his professional endeavors, Casey enjoys life with his wife, Morgan Taylor Burks. Together, they treasure their roles as parents to four wonderful daughters. The Burks family finds joy and connection through music, active church participation, and dedicated service to their community.

With a singular dedication throughout his career, Casey remains committed to the core principle of TSA Financial: ensuring retirement assets remain secure, protected, and steadily growing for all his clients.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in November 2025

- There are no events scheduled during these dates.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.